Table of contents

Intro to Apple Pay

We now look to our phones to help us take care of daily life—everything from checking the weather to plowing through email or monitoring our health. So it only makes sense that people are increasingly using their smartphones as a way to pay for things at stores. Apple Pay is perhaps the buzziest example of these new mobile wallet services.

Seven Frequently Asked Questions About Apple Pay

What is Apple Pay?

Apple Pay is Apple’s mobile wallet. In stores, Apple Pay allows you to check out and pay by holding your phone over a payments reader that can accept Apple Pay. In apps, Apple Pay allows you to trigger a payment from just a tap on your phone.

Which Apple devices have Apple Pay?

In stores, Apple Pay works on the iPhone 6 or newer as well as the Apple Watch. In apps, Apple Pay works with the iPhone 6 or newer, plus the iPad Air 2, iPad Pro ,and iPad mini 3 and 4.

How can I get Apple Pay?

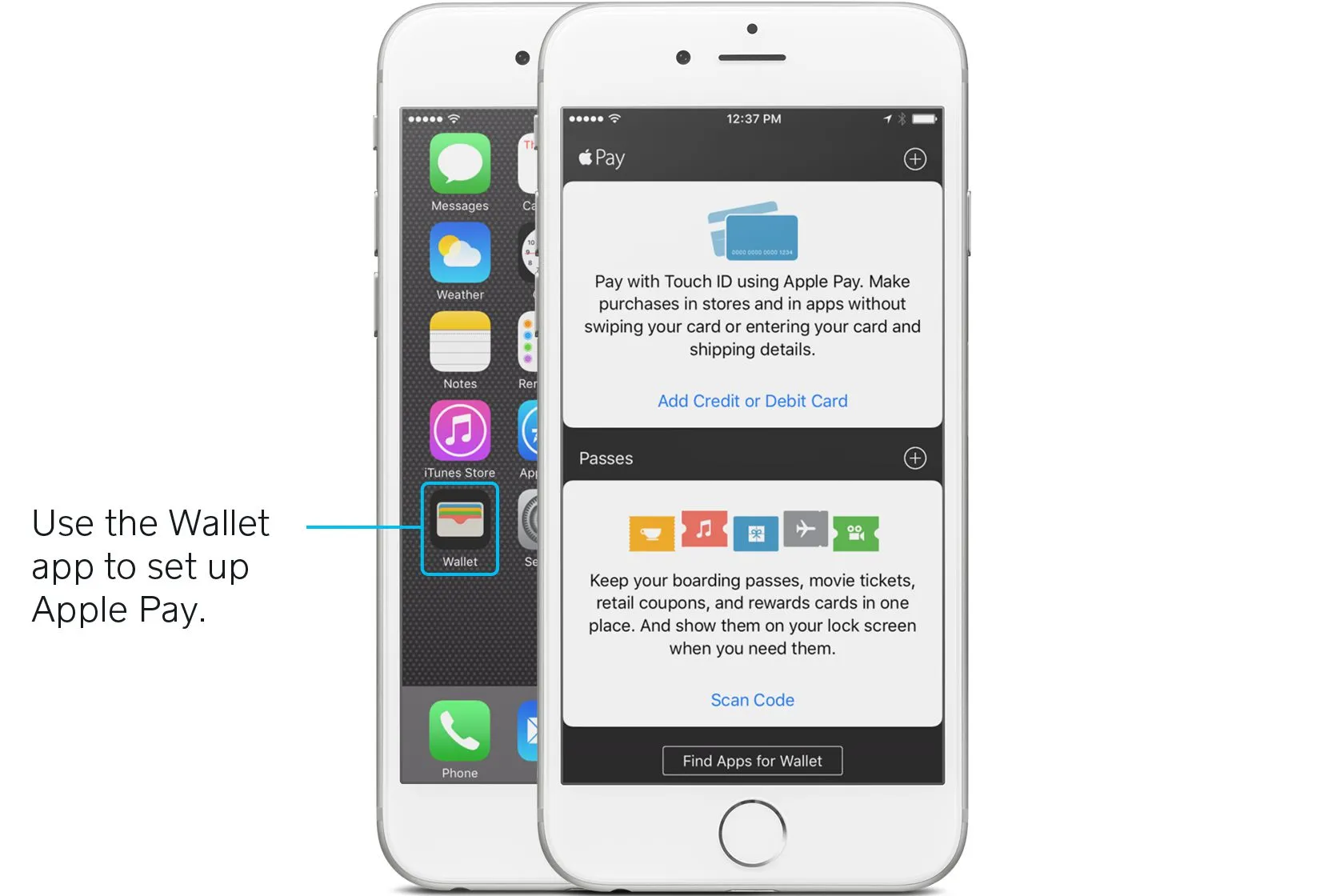

To get Apple Pay, first open up Wallet on a supported Apple device. Then, using your device’s camera, take pictures of the cards you’d like to load into your mobile wallet. If you already have a card associated with your iTunes account, you can use that as well.

How do I use Apple Pay?

To use Apple Pay at stores, just hold your device up to the NFC-enabled reader with your finger on the Touch ID button (the Home button). That triggers the payment. There’s no need to open the app or wake up your phone to use Apple Pay.

Is Apple Pay secure?

With Apple Pay, your debit or credit card number is never actually stored on your device. Apple assigns a unique number to every purchase, so your payments stay secure. If your phone is lost or stolen, you’re also protected by Touch ID, Apple’s fingerprint technology.

What are the benefits of Apple Pay?

Besides being secure, Apple Pay payments are quick to process. The transaction takes just seconds, which is noticeably faster than transactions on physical cards (especially EMV transactions).

How can I accept Apple Pay at my business?

To accept Apple Pay at your business, you need a reader that’s equipped with NFC (near field communication technology. The Square chip and contactless reader is enabled with NFC.

How to set up Apple Pay

If you own a business, it’s a good idea to stay up to speed with the latest in new payments technologies, like Apple Pay. As Apple Pay continues to take off, people will want to use it at your store, so being familiar with how things work on the buyer side of things will help prevent any fumbling on your end. And the best way to learn about Apple Pay is to try it out for yourself.

It’s relatively easy to enable Apple Pay on your device. To set it up, first open up Wallet. The next step is to load up the credit or debit cards you’d like “on file” in the system. Apple Pay works with most major credit and debit cards from Canadian banks. You can check a full list of banks that participate in Apple Pay on Apple’s site. When you add your participating cards to your Wallet, you still get all the rewards, benefits, and security features of your cards. As an added layer of security, you’ll have to set up Touch ID if you haven’t already.

So how do you actually add a card to Apple Pay? If you already have a card associated with your iTunes account, it’s super-easy. Just select the option to add that card to Apple Pay by entering the security code that’s on the back of your card. If you don’t have a card on file for your iTunes account, you just need to go through a few more steps. Use the iPhone’s camera to take a photo of your card and fill in any additional info the app asks for (like your security code). After your card is verified, voilà—you can start using Apple Pay anywhere that accepts it. Apple’s site has a handy step-by-step guide for how to set yourself up with Apple Pay, if you need some more help.

Apple Pay works with most major credit and debit cards.

Where you can use Apple Pay

Many large business across the country accept Apple Pay—London Drugs, Tim Hort

ons and Petro Canada, to name a few. We have a full list of retailers that now accept Apple Pay at the checkout counter. You can also check Apple Maps to see whether a store near you accepts Apple Pay. Just choose your location and look for the Apple Pay marker.

Stores that accept Apple Pay have a different kind of payments device—one that’s equipped with something called NFC (near field communication). NFC is technology that allows smartphones and devices (like a payments reader) to establish communication with each other when they’re close together. It’s what enables contactless payments, which are transactions that require no contact between the buyer’s smartphone or credit card and the POS terminal. Apple Pay is an example of a contactless payment.

On supported iPhones and iPads, you can also use Apple Pay to make purchases within apps. Apps like Airbnb and Target accept Apple Pay. You can check out a list of apps that accept Apple Pay on Apple’s site.

How to use Apple Pay at stores

As we mentioned, Apple Pay is an example of a contactless payment, meaning you can just hold your device near the payments reader to pay. You do have to be pretty close, though—a couple inches or less (that’s where the “near” part of near field communication comes in).

To initiate an Apple Pay payment on your phone, wait until the light on the payments reader comes on. There’s no need to open a new app or even wake up your display to use Apple Pay, thanks to that near field communication technology we talked about earlier.

Just hold your device up to the reader with your finger on the Touch ID button so it can scan your print. Once everything checks out, the payment is set in motion. If you have a number of cards on file, you can select your default card or choose another one. Within a few seconds, the transaction is complete. (You’ll see a checkbox on your device’s screen that indicates this.)

If you want to pay with a different card stored in Apple Pay, you can easily select a different one. Hold your phone near the payments reader, but don’t put your finger on the Touch ID button. When you see your default card on the screen, tap it and then tap the card you want to use instead. Then put your finger on the Touch ID button to make the payment.

How to use Apple Pay in apps

On supported iPhone and iPad models, you can use Apple Pay to pay for items with a single tap within apps. That means you no longer need to pull out your wallet and type out your card number, contact information and delivery details.

To use Apple Pay in apps, you first need to set yourself up with it, using the steps above. Then, when you want to pay for something within an app that accepts Apple Pay (the app will let you know if it does), all you have to do is choose Apple Pay as your payments option and activate the transaction using Touch ID. Complete the purchase with just your fingerprint.

Apple Pay security features

We’re used to keeping our credit cards close to the vest, so to speak. So it’s understandable that you might be nervous about using an entirely new vehicle to pay for things. But Apple Pay is actually extremely secure.

Apple Pay transactions are encrypted and secure.

Apple Pay uses sophisticated technology to encrypt and protect every transaction. For one, your debit or credit card numbers are never actually stored on your device. Instead, Apple assigns something called a Device Account Number to each added card, which is essentially a code name for that card. That Device Account Number is then encrypted and stored securely in something called the Secure Element, which is a dedicated chip in iPhone, iPad, and Apple Watch.

When you go to pay for something, that Device Account Number, along with a dynamic and transaction-specific security code, is used to process the transaction. So your actual credit or debit card numbers are never shared by Apple with merchants or transmitted with the payment. Each and every payment you make through Apple Pay has different information associated with it, so none of your data is stored with the merchant you’re buying from.

What’s more, Apple Pay payments are protected by Touch ID, which is Apple’s fingerprint technology. So even if your phone is stolen, your information is locked down. You can also use Apple’s Find My iPhone feature to quickly put your device into Lost Mode to suspend Apple Pay, which is an added layer of security.

The advantages of Apple Pay

Besides being incredibly secure Apple Pay has two other key benefits: convenience and speed.

Apple Pay transactions take just seconds.

Let’s look at speed first. The sophisticated technology behind an Apple Pay transaction means that payments take just seconds. That’s faster than magnetic-stripe card transactions, and noticeably faster than chip cards (EMV) transactions, which are known to be sluggish.

And then there’s convenience. Because it’s all through your mobile device (which you’re probably carrying around all the time anyway), using Apple Pay means that you don’t have to carry around a wallet stuffed to the brim. And if you leave your wallet at home, you won’t be left without a way to pay for things.

To accept Apple Pay, you’ll need an NFC-enabled payments reader.

How to accept Apple Pay at your business

According to the Square Future of Commerce report, about two thirds of retailers (67%) and restaurateurs (68%) surveyed offered mobile wallet payment options to customers such as CashApp Pay and Apple Pay. To accept Apple Pay (as well as chip cards), all you have to do is get the Square contactless + chip reader. It’s also really easy to get up and running. The new reader comes with easy-to-follow setup instructions so you can get set up to start taking Apple Pay in minutes. But as we mentioned above, before you start taking Apple Pay, it’s a good idea to familiarize yourself with how it works from the buyer side of the counter. Take a few test payments on your own so that you can walk customers through the ins and outs of paying with Apple Pay if they’re using the technology for the first time.

![]()

![]()